Hence, the overall invoice discounting process will be enhanced.

INVOICE FACTORING REQUIREMENTS VERIFICATION

Thus, the financial sector has started exploiting the decentralization since the financial crisis of 2011, and the potential of blockchain has already been studied in recent years ( Treleaven et al., 2017).įor the discounter the benefits of decentralization and blockchain adoption are as follows: (i) an immutable and time stamped record of the existence of every invoice emitted by a company, (ii) an immutable and time stamped record of the debtor's receipt, and (iii) the confirmation and verification of the invoice (against which a discounter would fund). However, the market changes in finance today pose the challenge to rethink the way banks deliver their services and to develop new market models ( Tank, 2018). This asymmetry can be maintained as far as there is a part in the ecosystem that is accountable for the whole process.

The actual legacy banking system has been based on a central database paradigm, which implies having a trusted and secure single point of failure and also implies an informative asymmetry in the ecosystem.

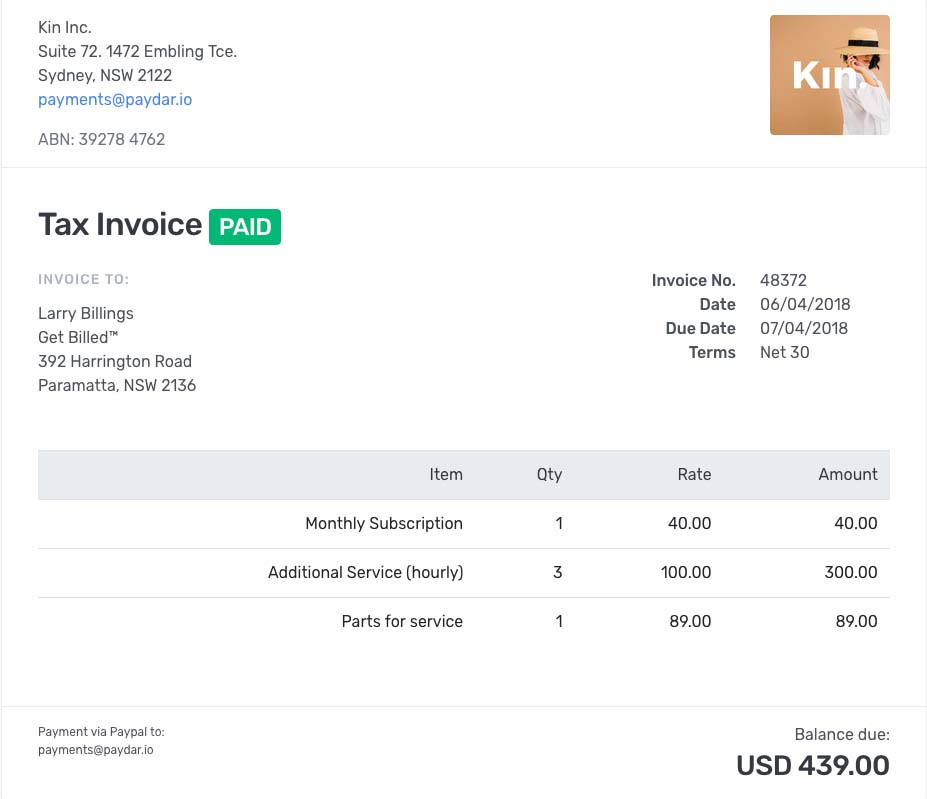

Invoice discounting is a typical financial business to business (B2B) process ( EUF, 2014). From the point of view of the suppliers' companies, the confidentiality is an advantage since, for easing negotiations with partners, they might not want to disclose their use of working capital finance. The customer (debtor) is not involved in the discounting process, hence it is not informed that the supplier (creditor) is getting his/her credit financed. Another advantage of invoice discounting is the confidentiality: namely, suppliers control the sales ledger by collecting payments as usual and sending out reminders. For European SMEs it has surpassed loans and other forms of financing over the past decade ( Wehinger, 2013). In particular, invoice discounting helps companies, especially Small and Medium Enterprises (SMEs), that have cash flow problems because of late payments from customers (i.e., invoices are usually paid in 30–90 days). Nowadays, invoice discounting represents 10% of banks' provided credit, and it has become a major source of working capital finance globally after the restriction of bank financing due to the 2011 credit crunch ( Wehinger, 2013). In this work we propose a decoupling layer, based on the Attribute-Based Access Control language, to unify the access control to reserved information across heterogeneous blockchains. In particular, since blockchain is still an emerging technology interoperability is a key factor for blockchain's adoption in inter-banking processes, where different blockchain solutions might be used. Moreover, we also discuss two main issues regarding the information accessibility and the interoperability. In our paper, we introduce a blockchain-based invoice discounting system, called Distributed Ledger Invoice, and we propose a novel assessment method for evaluating currently available blockchain solutions for the invoice discounting scenario. The benefits for suppliers, customers and financial institutions are related to the increased transparency added to the whole discounting process and the following risk reduction for the banks due to the capability to enhance the entire process and to reduce the double spending. The blockchain frameworks have the potential to provide the right solution and thus to revolutionize the invoice discounting process.

INVOICE FACTORING REQUIREMENTS HOW TO

More specifically, one of the most relevant problems today is how to provide better and faster invoice discounting services while preventing double spending and maintaining risk low. Hence, thanks to the quick availability of capital, businesses can invest in expansion and growth. The main benefit of invoice discounting is the acceleration of cash flow from customers to suppliers: suppliers get advance payments from the bank rather than waiting for the customers to pay. Invoice discounting is a market with a double-digit potential growth rate over the next years in Europe and worldwide.

3Fondazione Bruno Kessler, Trento, Italy.Nadia Fabrizio 1 *, Elisa Rossi 2, Andrea Martini 2, Dimitar Anastasovski 1, Paolo Cappello 1, Lorenzo Candeago 3,4,5 and Bruno Lepri 3

0 kommentar(er)

0 kommentar(er)